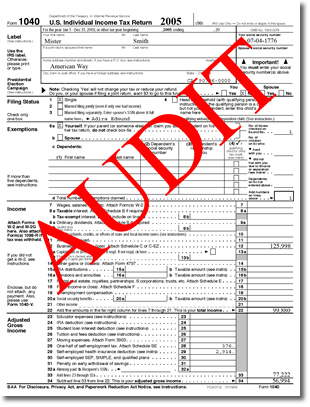

Tax Audit

An Audit is a Serious Problem Get Serious Tax Help

We understand you may be confused and frightened, getting an IRS or State Audit notice can take anyone’s breath away. We can help you get through the nightmare of an Audit with quick action and expert advice and representation. We have represented individuals and businesses of all sizes, our experience will guide you through the audit.

Sound Tax Consulting will get the facts, explain the process to you, and represent you throughout the audit with the IRS and or State.

First, contact us to find out if you need representation, not all audits require professional representation. Also if you have received an IRS “Notice of Deficiency” (uses the word Audit in the letter) it could be a minor or major issue depending on the facts, it is not an Audit in the true sense, but a notification that you missed including reported income in your tax return.

Second, if you need Audit Representation, our STC Tax Audit Team will guide you through the process throughout this complex process of filings and negotiations with the IRS or State.

Contact us 206-633-6089 or complete the Contact form.

Call us today; it is your Right to obtain representation.

FAQ’s

How far back can the IRS go to audit a tax return?

Generally, the IRS can include returns filed within the last three years in an audit. Additional years can be added if a substantial error is identified. Generally, the IRS will not go back more than the last six years.

The IRS tries to audit tax returns as soon as possible after they are filed; most audits will be of returns filed within the last two years

Why was your return selected for audit?

When returns are filed, they are compared against similar returns. The “norms” are developed from audits of a statistically valid random sample of returns.

Selecting a return for audit does not always suggest that an error has been made. Returns can be selected using a variety of methods, including:

-

Random selection and computer screening - sometimes returns are selected based solely on a statistical formula, or just bad luck.

-

Document matching - when your income records, such as Forms W-2 or Form 1099, don't match the information the IRS has received.

-

Related audits - returns may be selected for audit when other taxpayers, such as business partners or investors, whose returns were selected for audit. All clients of a particular tax preparer may be selected when the IRS discovers questionable business expenses, charitable donations, etc were present in all returns prepared by that tax preparer.

Should I represent myself?

Only if the audit appears simple you should represent yourself. For example, the IRS ONLY wants to verify that alimony payments were court ordered-simply send your divorce decree would suffice. Turning over all your records to the IRS Examiner without review by an experienced firm is frequently not in your best interest and if you are concerned it will be best to obtain an experienced opinion of your audit. Common sense should prevail here, if the audit is beyond your ability and comfort level, get representation.

Can my tax preparer, CPA represent me?

Yes, but only if they have audit experience. Make sure your audit is not first time audit training for them; don’t’ pay them to learn at your expense... Too often we are contacted after a client has discovered in the middle of audit the tax preparer or CPA has no experience and audit is going very badly.

At no cost or obligation to you, receive a FREE and CONFIDENTIAL CONSULTATION by calling us at 206-633-6089 You can also fill out an email form by clicking here but we suggest you take the quickest path towards your solution by calling. Take advantage of the 1-on-1 level of support that only a phone call can offer.

It's your first step to putting your tax problems behind you. Don't let worries of dealing with the IRS or State you into taking no action at all ... Get Help Now!